QuickBooks 2019+ IIF Import Issues

QuickBooks Changes

For some reason, Intuit significantly changed how QuickBooks 2019 and newer versions import IIF files.

By default, the new import process appears to take the IIF file and attempt to process it through the same code that the COM/SDK uses to validate data for import. This imposes many more rules and restrictions in an effort to ensure… something. We are not sure what. Unfortunately, this new error-checking imposes new and unneeded restrictions and has many omissions and bugs – all unhelpful at the least.

There are quite a few new issues which actually stop QuickBooks from importing normal and valid IIF files – files that have always worked and continue to work in preceding version years of QuickBooks. As a result, IIF files that used to work won’t anymore, at least by default. There are also issues where data in the IIF file is ignored and not imported, and where QuickBooks records something completely different than is in the IIF file.

We’ve released updates to our products to compensate for the most debilitating of these errors. However, there are remaining issues you may run into unless you follow these recommendations:

Import Options Overview

Newer versions of QuickBooks now offer two ways to import: The new default method and the older method (which continues to work appropriately) you may have used with older QuickBooks versions.

This second and recommended method is hidden behind a scary-looking link and resulting warning message. Ignore that. It’s nonsense.

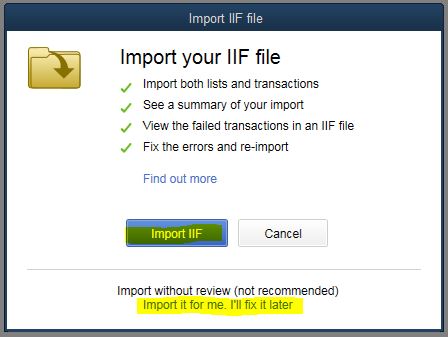

The two options highlighted:

The Import IIF button imports using the new and restrictive method.

The misleading and scary-sounding Import it for me link. I’ll fix it later link uses the method we’ve all been using with IIF files for 20+ years. IIF files work best using this option!

Recommendations

a. Use the Import it for me option!

- This option uses the more reliable and more accurate IIF import code. It is the same as older versions of QuickBooks.

- The “I’ll fix it later” text suggests you’ll have to fix something, but that misleading.

b. For our customers, download and install the latest builds of our products:

The latest builds will create IIF files that are a little different than older tools and usually work better with newer QuickBooks versions.

If you use the new/default Import IIF option (not recommended!)

- You may be blocked during your import attempt by issues that are not really issues.

- One of the known bugs may impact the import results.

- Import will be 10 – 20 times slower.

Known bugs using the new/default IIF import method

These are some of the new restrictions & bugs, most of which are avoided when using the recommended method above.

- When importing time records, QuickBooks may error and indicate that the related employee address is invalid – even though you are not importing changes to the employee.

- Import will fail if class field values on time records are not dates – but the class list is not a list of dates.

- The Send Later (email later) status for sales forms is ignored.

- QuickBooks will not import reverse/credit lines on transactions. For example, you can’t import a return line item on an invoice, a line that reduces the invoice total. – this may be fixed.

- It will not import 0.00 amount invoices (and perhaps other sales) even if the details of the invoice are non-zero.

- Document numbers are incorrectly limited to 12 characters though much larger values are actually allowed in QuickBooks.

- Phone numbers on name records are incorrectly limited in length which will often cause the extension to be omitted – while much longer values are actually accepted in QuickBooks.

- If you attempt to include a semi-colon (;) on a record in the IIF file, QuickBooks stops reading the line at the semi-colon. If there are required fields after that, the import fails. If optional fields, then they are not imported and you will lose data.

- If you include any characters with a ASCII value a little larger than a tilde (~) QuickBooks imports it as a “?” character.

- Characters include “€‚ƒ„…†‡ˆ‰Š‹ŒŽ‘’“”•–—˜™š›œžŸ ¡¢£¤¥¦§¨©ª«¬®¯°±²³´µ¶·¸¹º»¼½¾¿ÀÁÂÃÄÅÆÇÈÉÊËÌÍÎÏÐÑÒÓÔÕÖ×ØÙÚÛÜÝÞßàáâãäåæçèéêëìíîïðñòóôõö÷øùúûüýþÿ”

- Also higher-end characters beyond this range.

- So names and other text with European/international characters not import correctly. For example, René Cresté will import as “Ren? Crest?”.

- The reconciled status is ignored during import. All transactions are imported as uncleared, which completely defeats the use of the field.

- While the reconciled status is ignored, QB still checks the values and will block the entire import if there is a single reconciled status other than Y or N or empty. But both the IIF file format and QuickBooks support a third status, “newly cleared”, the “*” you can see in the register, which is represented in IIF using a third character.

- Import fails if you omit the customer on sales receipt transactions. But at the same time QB does not require a customer on sales receipt transactions. You can record them without a name, which is commonly done when importing daily sales transactions.

- When importing employees with perfectly formatted addresses – they are trashed: The City, State, ZIP fields are duplicated and entered in the second street address field.

- When importing a check with no check number (since it is not really a check, for example, but a debit charge) QuickBooks assigns a check number anyway. – this may be fixed.

- Budget records will not import – QuickBooks gives an error: “It’s a list or transaction that is not supported by the IIF import process.” Which is of course wrong.

- When importing Group items and their detail on sales transactions, QuickBooks ignores the contents of the IIF file and just applies the group as it exists on your items list. So, if you have customized the contents of the group, changed the amounts or the items included, all of that data is ignored.

- There are many more issues (we gave up documenting them all…)

-

-