Free download deed of trust form for idaho - excited

Make your Free

Deed of Trust

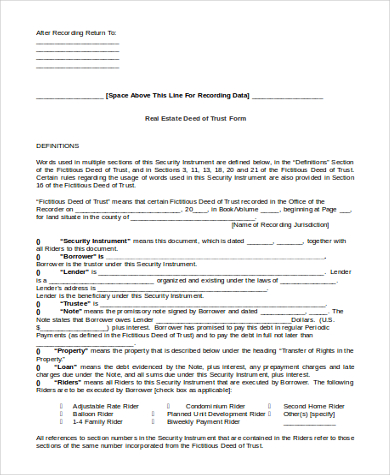

A Deed of Trust is part of the paperwork involved in buying property in many states. Our forms are customizable and include important sections including the power of sale, payment terms, tax and insurance requirements, and promissory note.

Use the Deed of Trust document if:

- You are selling a property in a Deed of Trust state.

- You are wanting to buy property in a Deed of Trust state.

Our Deed of Trust Forms can help you designate a trustee, often an attorney or title company, to hold the land title until the loan is paid off. These forms are suitable for all states that require Deed of Trusts. Learn which states allow deeds of trusts.

Other names for Deed of Trust:

Trust Deed, Mortgage Agreement (in some states)

What is needed to make a Deed of Trust

Most of the information in the contract is simple to collect such as contact information for the buyer, seller and trustee. Information that may need a bit of research to confirm include:

- Legal description of the property

- Date the loan will be paid in full

For your Deed of Trust to be legal, you'll need to have the document notarized and submitted to the appropriate local county recorder.

Deed of Trust vs Mortgage Agreement

Some states use Deeds of Trust and others use Mortgage Agreements. Both are used to essentially put a lien on a property to secure a loan to purchase that property. The difference is that a Deed of Trust includes a third-party trustee, borrower and lender. A mortgage includes just the borrower and lender. Most often if your state uses mortgages, it utilizes judicial foreclosures, which means the lender files a lawsuit for the right to foreclose. Deeds of Trust most often use non-judicial foreclosures, meaning the lender doesn't have to go through the court system if they want to foreclose. If you have already bought property and are not sure if you have a Deed of Trust or mortgage, you can review your original paperwork or contact your local land records office to see what kind of document you signed.

Who usually acts as the Trustee?

A trustee is a third-party person or entity responsible for acting as an impartial administrator in a non-judicial foreclosure. They are supposed to be fair and not partial to the buyer or seller. Some states even have laws that attempt to ensure that trustees are impartial, rather than partial to the lender or seller. Quite often the trustee is the title company. If the buyer defaults on the loan, the trustee is responsible for selling the property, paying the remainder of the loan, and distributing any profit. Since terms can be costly in the long run, you'll benefit from contacting a real estate attorney to help you ensure your paperwork is correct.

What is the power of sale?

The power of sale is a clause in a Deed of Trust or mortgage agreement that allows the lender or trustee to sell the property to repay the debt if the buyer defaults. Most often this clause is called a power of sale in a Deed of Trust and possibly a foreclosure in a mortgage document. You may also see the term power of sale foreclosure. Whatever it is called, it allows for the sale of the collateral (usually the property) to repay the loan without having to go through the state court system. These types of foreclosures called non-judicial foreclosures are processed much faster than those that involve the local judicial system. Most states allow power of sale foreclosures.

What is a deed?

Often people are confused about the difference between a deed and title. Deeds document the transfer of a title from one person to another. The title signifies ownership of a property. In the real estate business, a deed gives someone the right to claim ownership of the property while the person holding the title owns the property. In simple terms, if you hold the deed, you can act as the owner and improve the property, make alterations and occupy the property. But the title owner still actually owns the property until it is fully purchased. Once the person with the deed fully buys the property, they will receive the title.

Note: Not all states recognize a Trust Deed. If you live in these states, use a Mortgage Deed instead: Connecticut, Delaware, Florida, Indiana, Iowa, Kansas, Louisiana, New Jersey, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont, or Wisconsin.

Sample Deed of Trust

More than just a template, our step-by-step interview process makes it easy to create a Deed of Trust.

Save, sign, print, and download your document when you are done.

0 thoughts to “Free download deed of trust form for idaho”